estate trust tax return due date

You should file Form IL-1041. The first step is to pick a closing date for the trusts tax year known as the trust year-end.

The Generation Skipping Transfer Tax A Quick Guide

Filing Form 1041 with the IRS can be a daunting task.

. When filing an estate return the executor follows the due dates for estates. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

For all tax filing deadlines. For example for a trust or estate. For example for a trust or.

For trusts operating on a calendar year the trust tax return due date is April 15. Estate or Trust Tax Return by the original due date of the return to receive an extension for North Carolina purposes. If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to.

Suppose the grantor dies July 14. The types of taxes a deceased taxpayers estate. 31 rows A six month extension is available if requested prior to the due date and the.

Estimated Payments for Taxes. Due Date for Estates and Trusts Tax Returns. More In File Form 1041.

For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth. File an amended return for the estate or trust. Income from membership of Lloyds.

Returns filed before the extended due date of the return are treated as your original return for all purposes. If no federal estate tax return is required for the decedents estate the federal gift tax return due date is April 15th following the year of the decedents death. Due on the 15th day of the 4th month after the tax year ends.

Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of. California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. The first payment for a calendar year filer must be filed on or.

The IRS required that the fiduciary of a decedents estate or a. Some trusts must choose a calendar tax year. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

For calendar-year file on or before April 15 Form 1041 US. What is the due date for IRS Form 1041. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or domestic trust for which he or she acts.

Trust and Estate UK. Trust and Estate Partnership. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year 7.

Trust and Estate Trade. This is the US Income Tax Return for Estates and Trusts. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

The fiduciary of a domestic decedents estate trust or. For more information see Form IL-1041-X Instructions. E-file for Estates and Trusts.

Income Tax Return for Estates and Trusts PDF is used by the fiduciary of a domestic decedents estate trust or bankruptcy. Form 1041.

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

When Are Trust Tax Returns Due

Do I Have To Pay Income Tax On My Trust Distributions Carolina Family Estate Planning

The Bottom Line Tips For Proper Reporting Moldmaking Technology

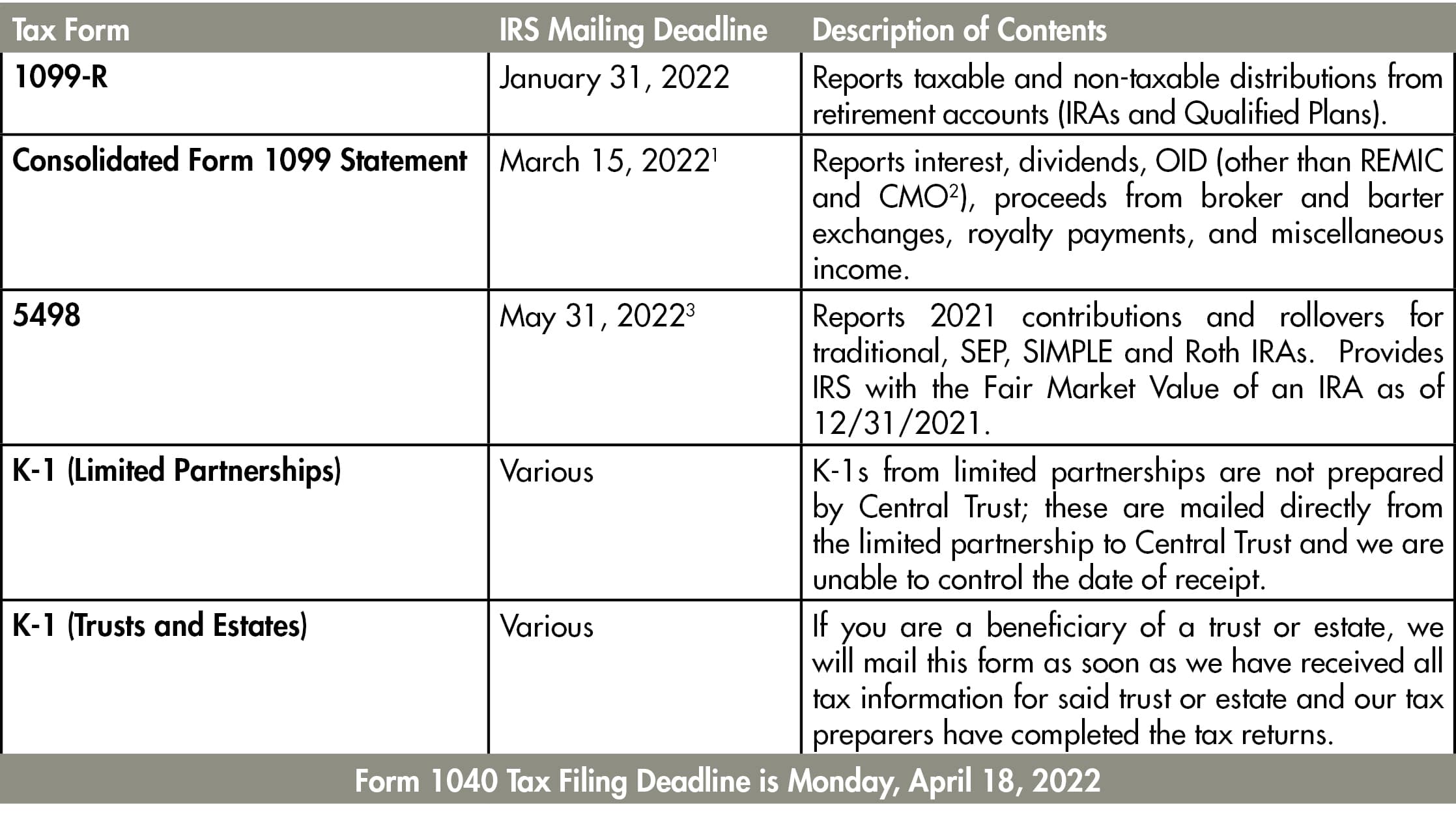

Tax Form Availability Central Trust Company

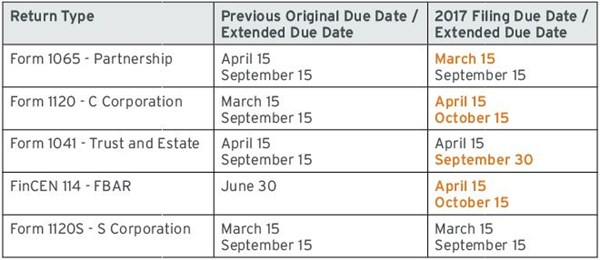

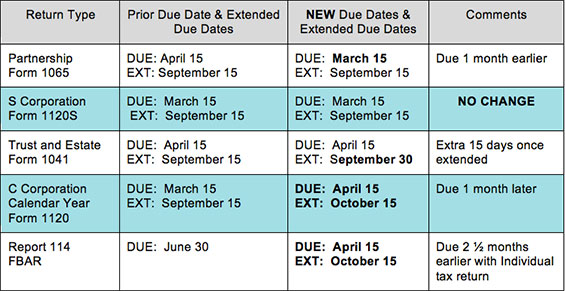

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Unexpected Tax Bills For Simple Trusts After Tax Reform

Income Tax Accounting For Trusts And Estates

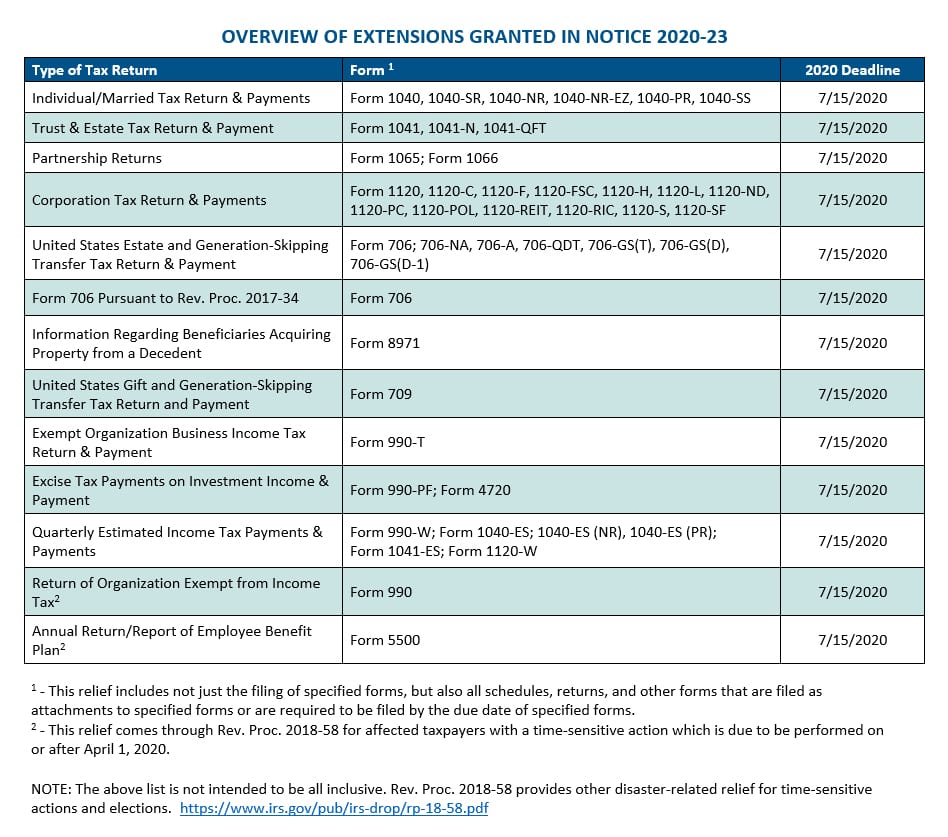

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/184283932-56a044915f9b58eba4af9970.jpg)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

News Alert Tax Return Due Dates Changes For 2016 Tax Year S J Gorowitz Accounting Tax Services P C

2021 Federal Tax Filing Deadlines 2022 Irs Tax Deadlines 1041 Due Date

2020 Us Tax Deadlines 2019 Tax Year Us Tax Financial Services

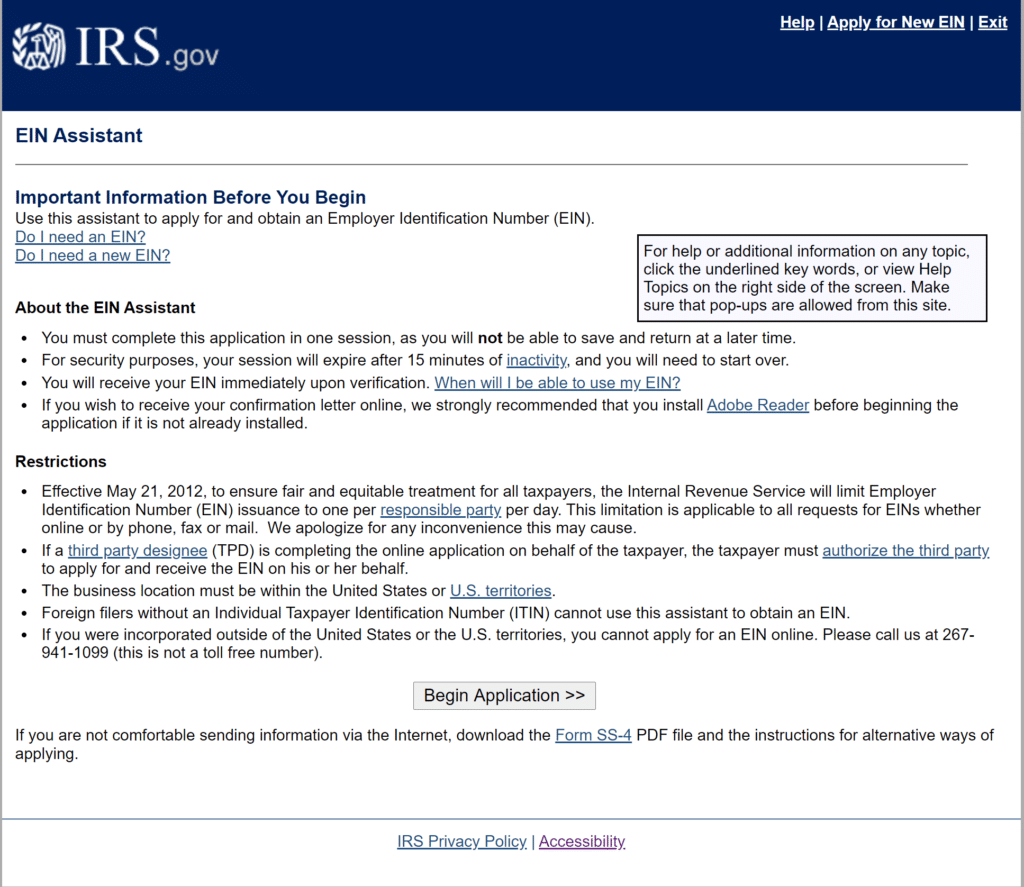

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Tax Deadlines Extended For Individuals Trusts And More Csh

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

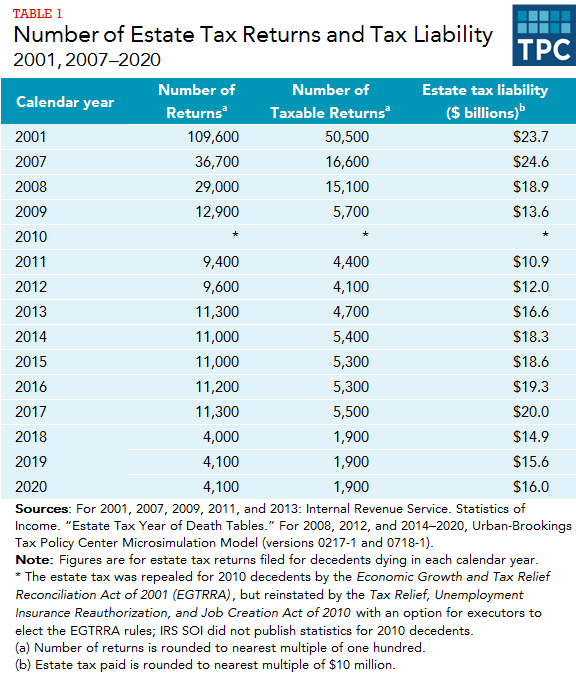

How Many People Pay The Estate Tax Tax Policy Center

Introduction To Income Tax Of Trusts Estates Youtube

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide